Leading Chip Substrate Manufacturers Driving Global Tech Growth

Chip substrates are foundational materials in semiconductor manufacturing, serving as the base that supports and connects the integrated circuits (ICs) to other electronic components. They provide a platform for electrical connections and thermal dissipation, making them essential for the functionality and reliability of semiconductor devices. Without high-quality chip substrates, the performance of chips, especially in advanced electronics, would be severely compromised.

Chip substrate manufacturers play a critical role in the global supply chain by providing these essential components. Their expertise in substrate design and production directly impacts the efficiency and innovation in the semiconductor industry. As demand for smaller, faster, and more energy-efficient devices continues to grow, chip substrate manufacturers are key in enabling these advancements. Their contribution not only supports the semiconductor industry but also influences broader technology sectors, including telecommunications, consumer electronics, and automotive systems.

Chip Substrate Manufacturers in the USA

The United States is home to several prominent chip substrate manufacturers that play a pivotal role in the global semiconductor industry. Companies like Intel, AMD, and Lam Research have invested significantly in developing advanced substrate technologies to support domestic chip production. While the US chip substrate manufacturers may not dominate the market in terms of sheer volume compared to Asian counterparts, they maintain a strong foothold in specialized, high-performance applications. For example, companies like AT&S USA and TTM Technologies focus on producing substrates for high-frequency, high-power electronics used in telecommunications, defense, and aerospace industries.

The US chip substrate industry is known for its technological innovation, with strengths in research and development (R&D), advanced manufacturing processes, and materials engineering. However, it also faces challenges such as a relatively smaller workforce and supply chain constraints compared to countries like Taiwan and South Korea. Additionally, the increasing demand for more complex substrates due to advancements in artificial intelligence (AI) and 5G poses further challenges to scaling production. Despite these hurdles, US chip substrate manufacturers remain critical players in the global supply chain, driving technological advancements and maintaining competitiveness through innovation.

Chip Substrate Manufacturers Near Me

Finding local or regional chip substrate manufacturers is essential for companies looking to optimize their supply chain and reduce lead times. To locate nearby manufacturers, businesses can start by using online directories, industry-specific platforms, and supplier databases such as ThomasNet or platforms like Metoree, which list semiconductor substrate suppliers by region. Attending local trade shows, semiconductor conferences, or networking events can also provide valuable opportunities to connect with manufacturers in your area.

Proximity to chip substrate manufacturers offers significant advantages in supply chain management. When manufacturers are located nearby, it reduces shipping times, minimizes transportation costs, and simplifies logistics, leading to faster production cycles. This can be particularly beneficial for industries with high demand for rapid innovation, such as consumer electronics, automotive, and telecommunications. Additionally, working with local manufacturers fosters closer collaboration, making it easier to implement custom substrate designs or resolve any issues quickly. Proximity also helps companies respond to sudden shifts in demand more efficiently, ensuring smoother operations and reduced risks of delays or disruptions in the supply chain.

Semiconductor Substrate Manufacturers

Semiconductor substrate manufacturers play a crucial role in the production of integrated circuits (ICs), as they provide the foundational materials upon which chips are built. These substrates serve as the base for placing and interconnecting various components within an IC, ensuring proper electrical connections and thermal management. Without high-quality substrates, the performance, reliability, and longevity of chips would be significantly impaired. Semiconductor substrate manufacturers are responsible for producing various types of substrates, such as silicon wafers, ceramic substrates, and advanced package substrates like ABF (Ajinomoto Build-up Film) and BT (Bismaleimide Triazine) resins, which are essential for different semiconductor packaging technologies.

Key global players dominate this sector, especially in Asia, where companies like Taiwan’s Unimicron, Japan’s Ibiden, and South Korea’s Samsung Electro-Mechanics lead the market. These manufacturers are known for their innovation and large-scale production capabilities, supplying substrates for advanced semiconductor applications like CPUs, GPUs, and 5G chipsets. Their influence on the global market is substantial, as they provide the bulk of the substrates used by major semiconductor companies. In comparison, manufacturers in Europe and the US, while highly specialized, often cater to niche markets with specific requirements for high-frequency or high-power applications. The dominance of Asian manufacturers is largely due to their ability to scale production efficiently, maintain cost advantages, and invest heavily in cutting-edge technologies for next-generation substrates.

Semiconductor Package Substrate vs PCB

Semiconductor package substrates and printed circuit boards (PCBs) are both crucial components in electronics, but they serve different purposes and are designed with distinct materials and technologies. A semiconductor package substrate acts as a platform that connects the semiconductor die to the external circuitry, ensuring electrical connections between the IC and the rest of the system. It provides mechanical support, electrical interconnections, and heat dissipation for the die. In contrast, a PCB is used to connect multiple electronic components, including packaged semiconductors, resistors, capacitors, and other devices, through conductive pathways etched onto the board.

The materials used for semiconductor package substrates typically include ABF (Ajinomoto Build-up Film) or BT (Bismaleimide Triazine) resin, which offer superior electrical insulation and high thermal stability, making them ideal for use in high-performance IC packaging. PCBs, on the other hand, are typically made from FR4, a fiberglass-reinforced epoxy laminate, or ceramic-based materials for high-temperature applications. These materials are more suited for general-purpose electronics where large interconnections and mechanical support are necessary.

In terms of design, package substrates are more complex and require fine-pitch, high-density interconnections to accommodate the miniaturization of modern ICs. They often involve multi-layered structures to ensure efficient routing of signals between the chip and the external environment, while maintaining a compact form. PCBs, although multi-layered as well, have larger traces and are designed to interconnect entire systems, rather than focusing on the fine-scale connections required for individual chips.

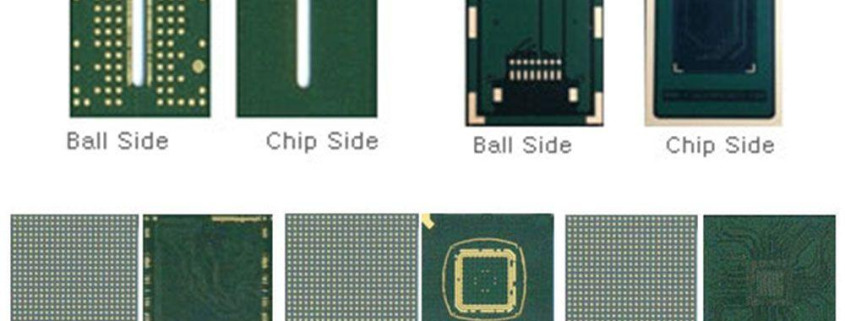

The use cases for package substrates and PCBs are distinct. Package substrates are critical in high-performance IC packaging, including BGA (Ball Grid Array) and FCBGA (Flip-Chip Ball Grid Array) packages, where precision and thermal management are vital. PCBs, meanwhile, are essential in virtually all electronics, from consumer gadgets to industrial machinery, acting as the backbone that integrates and connects multiple components within a system.

Semiconductor Substrate Materials

Semiconductor substrates are made from a variety of materials, each chosen for its specific electrical, thermal, and mechanical properties. Silicon is the most common material used in semiconductor substrates due to its excellent semiconductor properties and cost-efficiency. Silicon substrates are used for most integrated circuits (ICs), including microprocessors and memory chips. Silicon’s relatively low thermal expansion and high conductivity make it ideal for managing heat in semiconductor devices. Moreover, it is abundant and cost-effective to manufacture at scale.

Glass substrates are increasingly being used in certain semiconductor applications, particularly in high-frequency RF devices and advanced display technologies. Glass offers superior electrical insulation and excellent surface smoothness, which is critical for precise circuit patterns. Additionally, glass substrates have a lower coefficient of thermal expansion, making them suitable for applications that require high precision and minimal distortion under heat.

Ceramic substrates, such as alumina (Al2O3) or silicon carbide (SiC), are employed in high-power and high-temperature applications due to their excellent thermal conductivity and resistance to extreme conditions. These materials are particularly useful in applications like power electronics and LEDs, where effective thermal management is crucial to device longevity and performance. Ceramic substrates also provide exceptional electrical insulation, making them ideal for environments where high voltages are present.

The choice of substrate material significantly impacts the thermal management of semiconductor devices. For example, ceramic substrates efficiently dissipate heat, reducing the risk of overheating in high-power devices. In contrast, while silicon offers good thermal management, it may require additional cooling solutions in more demanding applications.

Electrical performance is also closely tied to the substrate material. Glass and ceramics provide superior electrical insulation compared to silicon, which helps reduce interference and improve signal integrity in high-frequency applications. However, these materials tend to be more expensive than silicon, influencing the overall manufacturing costs. Silicon remains the most cost-effective option for mass production, while glass and ceramic substrates are reserved for specialized, high-performance applications where their advantages outweigh the higher costs.

By selecting the appropriate substrate material, manufacturers can optimize semiconductor devices for performance, reliability, and cost-efficiency in various applications.

US-Based Semiconductor Manufacturers

The landscape of US-based semiconductor manufacturers is evolving as the country seeks to regain leadership in the global chip industry. Prominent semiconductor companies like Intel, AMD, Qualcomm, and GlobalFoundries play critical roles in driving innovation and supporting local substrate suppliers. These companies are not only focused on designing advanced integrated circuits (ICs) but are also actively involved in strengthening domestic supply chains, particularly by collaborating with US-based substrate manufacturers.

One of the most notable players, Intel, has taken significant steps to reshore chip production through its Intel Foundry Services (IFS) initiative. This strategy aims to rebuild the semiconductor manufacturing ecosystem in the United States, reducing reliance on overseas suppliers and ensuring a more resilient supply chain. Intel’s investment in new fabs, such as the Ohio facility and Arizona expansion, will create demand for locally sourced materials, including chip substrates, which are crucial for packaging their advanced chips.

Intel’s collaborations with local substrate manufacturers focus on developing high-performance semiconductor packaging solutions like FCBGA (Flip-Chip Ball Grid Array) and advanced interposers that are vital for scaling performance in modern processors. These partnerships help to foster technological innovations, optimize production efficiency, and ensure that Intel can meet the growing demand for cutting-edge semiconductor devices used in industries such as AI, 5G, and autonomous vehicles.

Other companies like GlobalFoundries, headquartered in New York, are also working closely with US-based substrate suppliers as part of their strategy to expand domestic chip production. By building partnerships with local substrate manufacturers, they aim to shorten lead times, improve quality control, and ensure that the advanced packaging materials required for semiconductor devices can be sourced more reliably.

Overall, US-based semiconductor manufacturers are at the forefront of reshoring efforts, which are key to supporting local substrate suppliers. Their strategies involve large-scale investments in infrastructure, fostering closer collaboration with domestic substrate manufacturers to strengthen the entire supply chain and reduce vulnerabilities that were exposed by recent global chip shortages. As the US government introduces initiatives like the CHIPS Act, which provides funding to boost semiconductor manufacturing, these companies are poised to play a larger role in driving both chip production and substrate development within the United States.

Semiconductor Packaging Companies

Semiconductor packaging companies play a critical role in the final stages of chip production, where they encapsulate and protect semiconductor devices while providing the necessary electrical connections between the chip and external systems. Many companies that specialize in semiconductor packaging often overlap with substrate manufacturing, as the packaging substrate is a crucial component that directly impacts the chip’s overall performance and reliability. Companies such as Amkor Technology, ASE Group, and SPIL (Siliconware Precision Industries) are global leaders in semiconductor packaging, and they also engage in substrate manufacturing or collaborate with leading substrate suppliers to ensure high-quality packaging solutions.

These companies offer a wide range of advanced packaging techniques, including Ball Grid Array (BGA), Chip-on-Board (COB), Fan-Out Wafer-Level Packaging (FOWLP), and Flip-Chip Packaging, all of which rely on specialized substrates to achieve their performance objectives. For instance, packaging substrates such as ABF (Ajinomoto Build-up Film) and BT (Bismaleimide Triazine) resins are commonly used in advanced packaging designs because they support fine-pitch interconnections, enhanced signal integrity, and effective heat dissipation.

The importance of packaging substrates cannot be overstated in the semiconductor industry. They are responsible for not only providing the physical structure to house the semiconductor die but also ensuring that the chip performs optimally by maintaining strong electrical connections and managing thermal dissipation. This is particularly vital in applications like high-performance computing (HPC), 5G, artificial intelligence (AI), and automotive electronics, where chips are subject to extreme operating conditions and require reliable performance over extended periods.

Substrate materials in packaging must withstand thermal cycling, moisture, vibration, and mechanical stress while maintaining their electrical integrity. Companies that specialize in semiconductor packaging invest heavily in research and development to innovate substrates that can enhance chip performance in these challenging environments. The ongoing trend toward miniaturization and higher chip density further underscores the role of packaging substrates in ensuring chips operate efficiently without compromising signal transmission or thermal management.

Through collaboration with substrate manufacturers, packaging companies ensure they can meet the rigorous demands of modern semiconductor devices, offering reliable and scalable solutions that enhance the performance and longevity of the chips.

FAQs About chip substrate manufacturers

Some of the largest IC substrate manufacturers globally include:

Unimicron Technology (Taiwan)

Ibiden (Japan)

Shinko Electric Industries (Japan)

Kinsus Interconnect Technology (Taiwan)

Nan Ya PCB (Taiwan) These companies dominate the global market by providing high-performance substrates used in semiconductor packaging, particularly for advanced chips in industries like computing, telecommunications, and automotive.

In chip manufacturing, a substrate serves as the base layer onto which semiconductor dies (chips) are mounted and connected. Substrates provide mechanical support, electrical interconnections, and thermal management for the chip. They are made from materials like silicon, ceramic, glass, or resin-based materials (such as ABF or BT), and play a crucial role in maintaining the chip’s performance, reliability, and heat dissipation.

The world’s largest chip manufacturer is Taiwan Semiconductor Manufacturing Company (TSMC), based in Taiwan. TSMC dominates the global market for semiconductor manufacturing, particularly in advanced process nodes, producing chips for major tech companies like Apple, NVIDIA, and AMD.

Yes, several US-based chip manufacturers include:

Intel (one of the largest global semiconductor companies)

GlobalFoundries (though originally founded by AMD, it is now an independent US-based foundry)

Qualcomm (designs chips but outsources manufacturing) These companies focus on both chip design and manufacturing, with Intel and GlobalFoundries investing heavily in domestic production facilities as part of reshoring efforts, especially under the CHIPS Act.